What exactly is the difference between a public purpose and charitable purpose when filing California articles for a non profit? - Quora

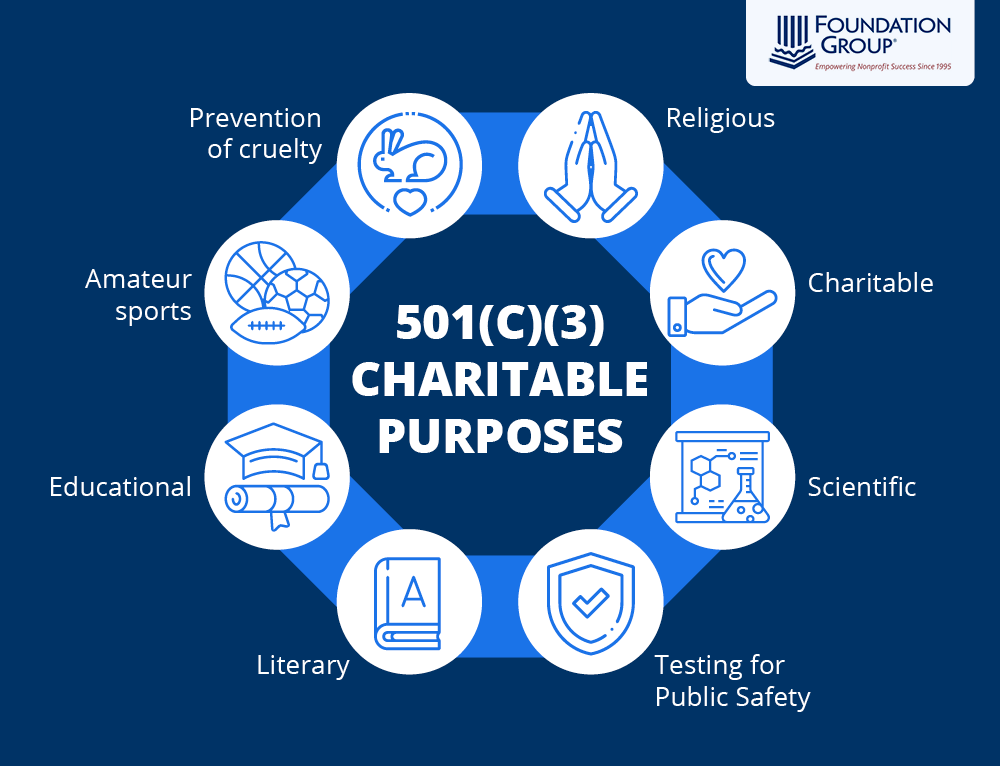

Tax exempt status under section 501(c)(3) of the Internal Revenue Code (IRC) grants an organization the significant benefits of

![What Are the Articles of Incorporation for Non Profit: A Step-By-Step Guide to Incorporation [With a Sample Template] • Glue Up What Are the Articles of Incorporation for Non Profit: A Step-By-Step Guide to Incorporation [With a Sample Template] • Glue Up](https://www.glueup.com/sites/default/files/image_1343.png)

What Are the Articles of Incorporation for Non Profit: A Step-By-Step Guide to Incorporation [With a Sample Template] • Glue Up

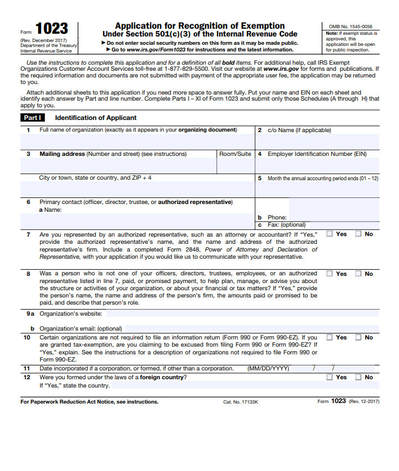

Form 1023-EZ: The Faster, Easier 501(c)(3) Application for Small Nonprofits — Aspect Law Group | A media and entertainment law firm.

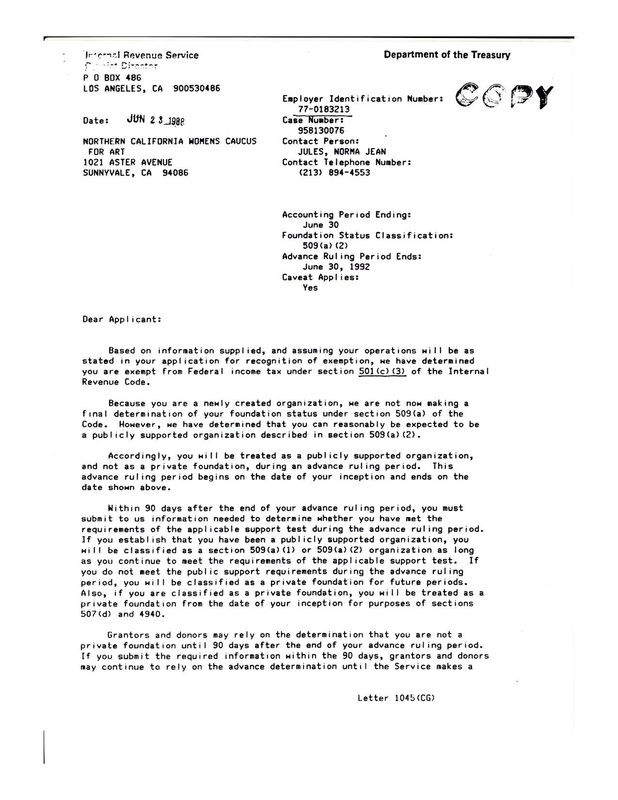

Can I get a copy of the IRS Declaration Letter granting 501(c)(3) status? - Pawsitivity Service Dogs

![What Are the Articles of Incorporation for Non Profit: A Step-By-Step Guide to Incorporation [With a Sample Template] • Glue Up What Are the Articles of Incorporation for Non Profit: A Step-By-Step Guide to Incorporation [With a Sample Template] • Glue Up](https://www.glueup.com/sites/default/files/image_1580.png)

What Are the Articles of Incorporation for Non Profit: A Step-By-Step Guide to Incorporation [With a Sample Template] • Glue Up