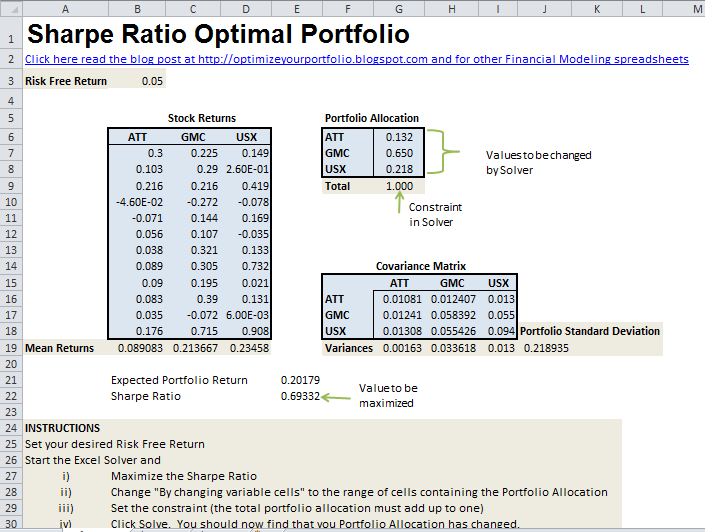

Portfolio Optimization with Python: using SciPy Optimize & Monte Carlo Method | by Ebrahim Pichka | DataDrivenInvestor

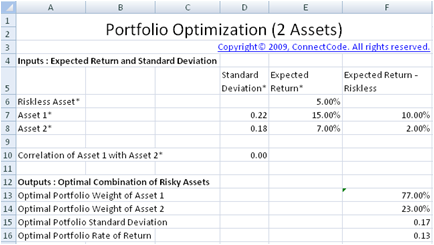

python - Compute tangency portfolio with asset allocation constraints - Quantitative Finance Stack Exchange

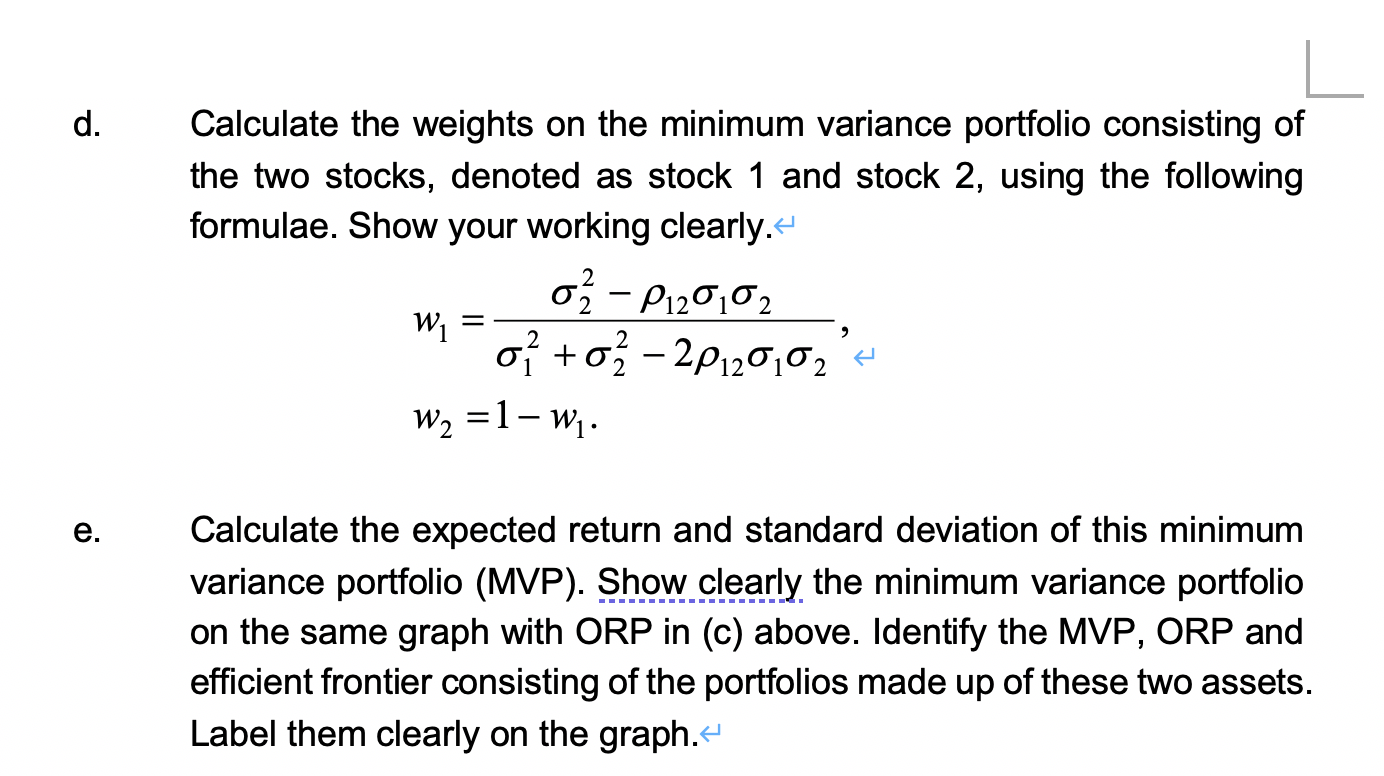

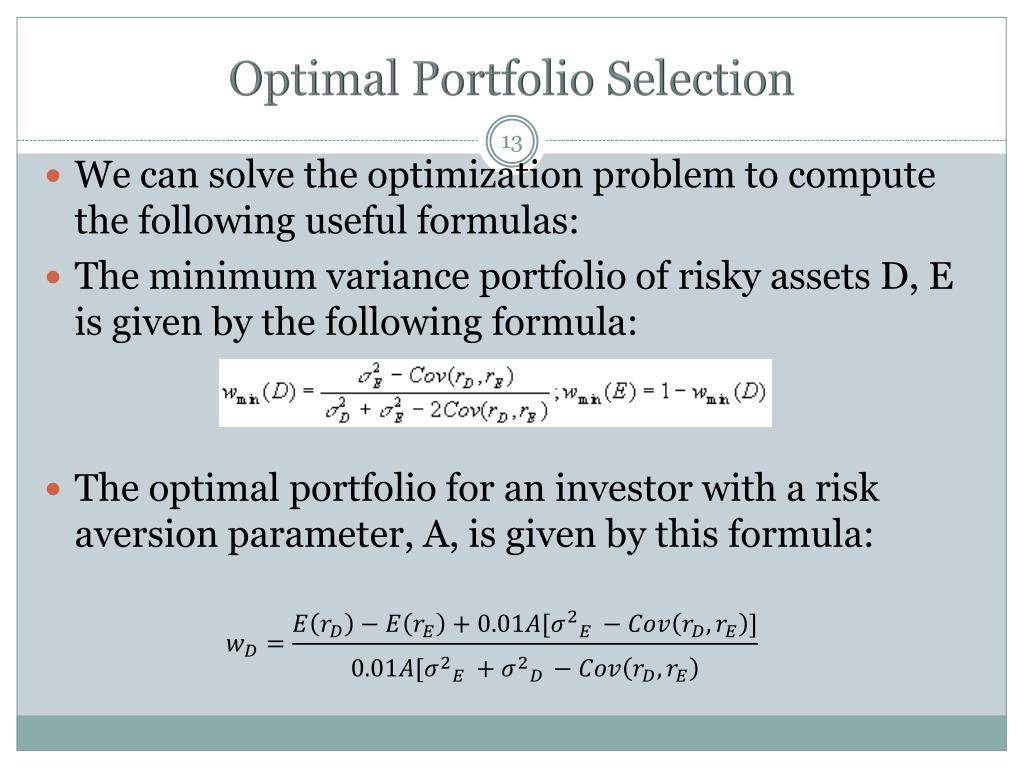

optimization - Formula for Optimal Portfolio of 2 Assets when No Shorting Allowed? - Quantitative Finance Stack Exchange

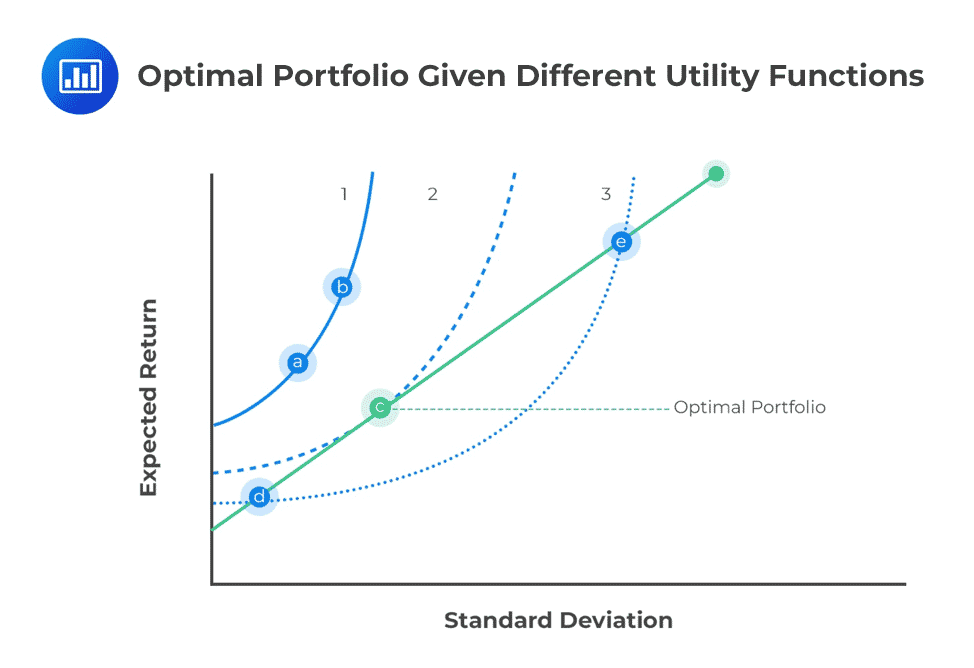

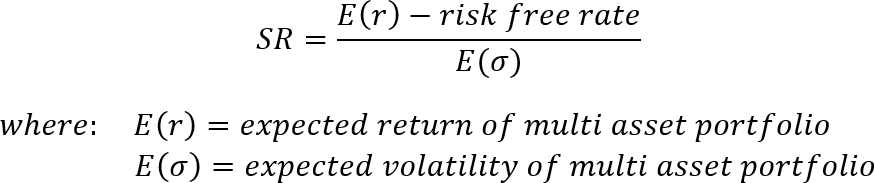

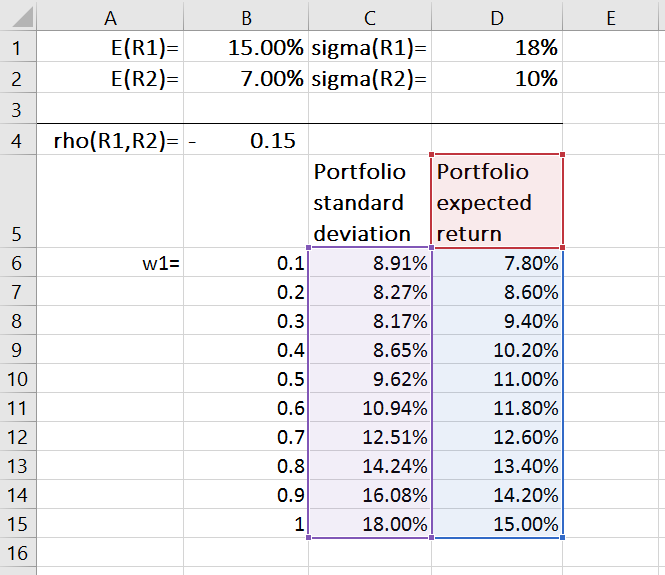

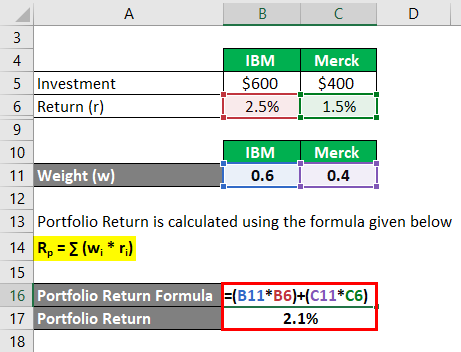

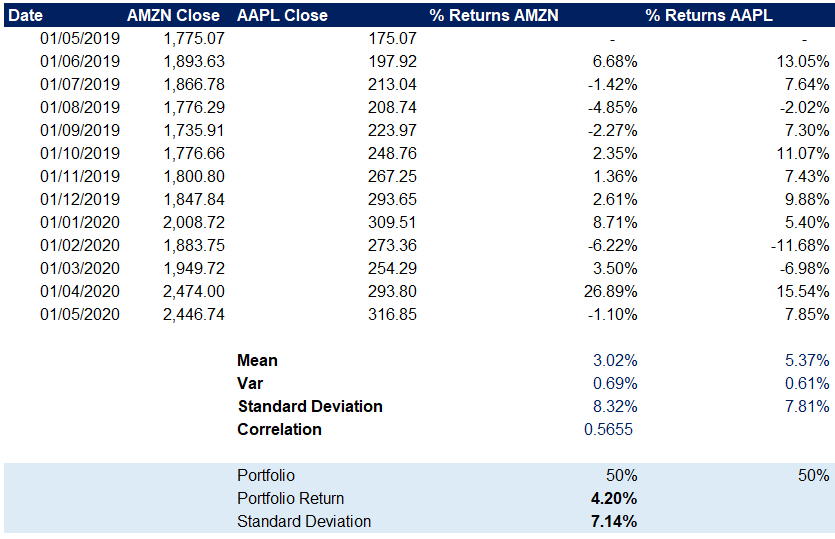

Optimal Portfolios and the Efficient Frontier | by Dobromir Dikov, FCCA, FMVA | Magnimetrics | Medium

Optimal Portfolios and the Efficient Frontier | by Dobromir Dikov, FCCA, FMVA | Magnimetrics | Medium